| City | Pacific Grove, CA |

| Dates Analyzed | June 30 through July 7 |

| Property Type | Single-Family Residential |

| # of Homes For Sale | 88 |

| Avg List Price | $ 1,200,641 |

| Median List Price | $ 729,450 |

| # of Homes Sold | 4 |

| Avg Asking Price | $ 618,250 |

| Avg Sales Price | $ 577,000 |

| Achievement Rate | 93% |

| Median Sales Price | $ 534,000 |

| Avg Days on Market | 80 |

| Notes | Homes for sale in Pacific Grove number 88. With approximately 16 homes selling per month in Pacific Grove, there are about 5.5 months of inventory. This is a great sign, indicating a seller’s market in Pacific Grove. Achievement rate, percentage of asking price attained in sale, is healthy at 93%. And homes are selling in just over 2 months. I’m looking for Pacific Grove to have a strong Summer. |

Tag Archives: pacific grove realtor

REALTOR® Magazine-Daily News-4 Keys to Selling in Today’s Market

REALTOR® Magazine-Daily News-4 Keys to Selling in Today’s Market.

4 Keys to Selling in Today’s Market

Home sales and prices are still dropping around the country as huge inventories of foreclosures and short sales continue to weigh on many markets. So how can traditional sellers stand out in a crowded real estate marketplace? CNNMoney.com recently highlighted several keys to getting a home sold in a tough real estate market.

1. Cut your price by a lot. Buyers nowadays want to feel they are getting a “steal,” real estate experts say. But some sellers may be tempted to list a property above fair market value just to test out the market and see if they can get a taker. In the past year, about 25 percent of sellers who initially listed their homes too high ended up having to reduce the price, according to Trulia.com.

“The first 30 days on the market are the most important,” says Elizabeth Kamar, a real estate professional in Norwalk, Conn. That crucial time is when the home gets the most attention and showings. For sellers who aren’t realistic about the price from the get-go, they often end up with less than they would have if they priced it right initially, Kamar says.

Experts also note that if after 30 days on the market there are still no buyers, sellers may need to make a big move.

“When a property sits, people start thinking it must be listed too high,” says Ellen Klein, a real estate professional in Rockaway, N.J. She suggests making a giant price cut–as much as 10 percent of the asking price–which may be extra motivation for buyers to take a second look or attract a new pool of potential buyers seeking a lower price range.

2. Play hardball in negotiations. Sellers shouldn’t feel they have to accept any lowball offer that comes their way. However, if a buyer is willing to negotiate, that’s when sellers need to try to set aside feelings of anger or insult and start to counteroffer, says Mabel Guzman, president of the Chicago Association of REALTORS®. Guzman says the ideal is that you’ll be able to negotiate within $10,000 to $20,000 of an acceptable offer. Using incentives–such as agreeing to leave the appliances–may get buyers to budge in agreeing to a higher price.

3. Stage it. Staging is becoming popular in trying to sell mid-range homes. Professional stagers will help home owners highlight key areas of a home and often rearranges furniture or bring new furniture in, repaint, and get the home looking like it’s ripped from a catalog. Real estate brokers say that proper staging can actually speed up a sale and increase the final sales price too.

4. Get the home in front of as many buyers as possible. The real estate professional needs to get creative in the marketing to make sure the home gets a lot of attention from buyers.“The more eyeballs that get on the listing, the better,” says Katie Curnutte of the real estate information web site Zillow.com.

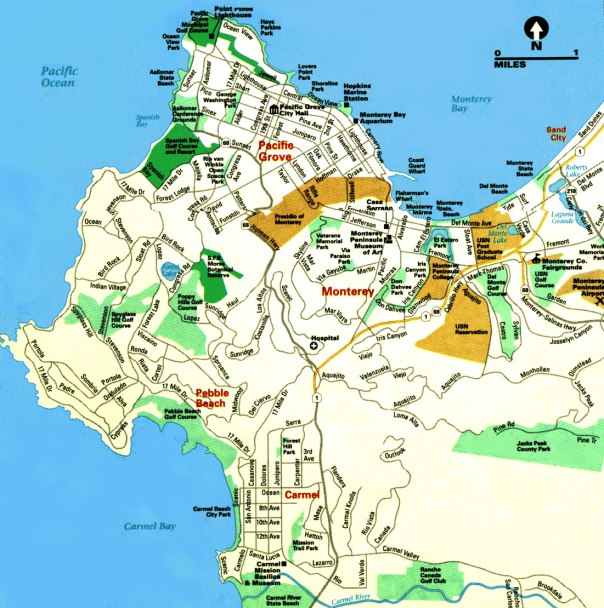

What’s Selling on the Monterey Peninsula?; April 18, 2011

We are three-and-a-half months into the year (2011). Everyone is sitting on the edge of their seat, anticipating a perspective; some sort of idea as to where we are in this economic roller coaster. The housing market plays a huge roll in our position. I try to share information in this blog that helps you get a feel for where you can position yourself on your seat…on the edge or comfortably against the back-rest.

Today I’m reporting the status of single-family residential real estate sales year-to-date on the Monterey Peninsula (Carmel, Monterey, Pacific Grove, Pebble Beach). Comparing the same time period in 2010 to 2011 is a nice way see where we were and where we’re going. As you can see below, inventory is up 26%, number of sales is down 29%, Foreclosures are up 26%, Short Sales are up 47%, average and median sales prices have remained steady, and average days on market (DOM) has increased by 13%.

| 2010 | 2011 | %Difference | ||

| New Listings | 322 | 435 | 26% | |

| Sold Listings | 148 | 115 | -29% | |

| Foreclosed Listings | 31 | 42 | 26% | |

| Short Sale Listings | 31 | 59 | 47% | |

| Avg Sales Price | $1,237,553 | $1,245,040 | 1% | |

| Median Sales Price | $797,500 | $800,000 | 0% | |

| Avg DOM | 114 | 131 | 13% | |

Monterey Peninsula Real Estate – Where are we now? April 6, 2011

Monterey Peninsula Real Estate – Where are we now?

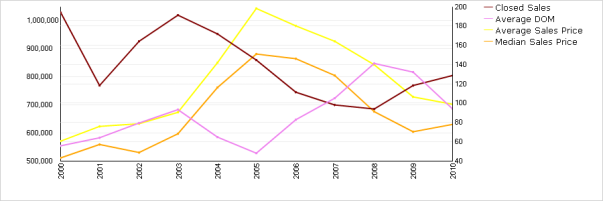

Below is a graph that shows us where our real estate market is now and where it has been over the past 10 years (2000 through 2010). Each graph is for a particular city, including figures for single-family residential homes in Carmel, Monterey, Pacific Grove, Pebble Beach, and Seaside. We follow the number of home sales, the average home sale price, median home sale price, and the average days on market (DOM).

The variables indicated, help us see where we are at right now, what we can expect to purchase a home for, and how we can reasonably price our home for sale. For example, if my home was worth $1,000,000 in 2005 and the median sales price has decreased by 25% since 2005, then with all else remaining the same, I can expect to receive about $750,000 for my home today. On the same, and more encouraging, front, if a home that I want to buy was purchased for $1,000,000 in 2005 and the median sales price of homes in the area has decreased by 25%, then I know that $750,000 is a reasonable asking price from the seller.

Carmel:

Monterey:

Pacific Grove:

Pebble Beach:

Seaside:

The line graphs above show us where the real estate market on the Monterey Peninsula is today and where it has been over the past 10 years. I have the same statistics, including more detailed figures, in a spreadsheet format that I can EMAIL TO YOU UPON YOUR REQUEST.

Please enjoy this information and don’t hesitate to contact me to discuss it further. I look forward to your inquiries, our discussions, and helping you and your friends with your real estate needs.

~ Zach

What’s Selling in Pacific Grove, CA; March 25, 2011

37 homes have sold in Pacific Grove since the beginning of the year. That’s approximately 12 homes per month. There are currently 70 homes for sale in Pacific Grove. With 12 homes selling per month, PG has just under 6 months of inventory. This is VERY exciting news for the area.

As I’ve shared before, 6 months of inventory is an indicator of a neutral real estate market. Below 6 months is a sign of a “seller’s market“, above 6 months tells us that we’re in a “buyer’s market.”

For the first time since the first quarter of 2008, the Pacific Grove real estate market appears to stepped over the hump into “Sellersville.” The market is still very delicate though. Homes that are not priced properly sit on the market unsold until the seller is willing to adjust the price as necessary to attract today’s savvy buyers.

Here’s why I believe that Pacific Grove is seeing such progress in its real estate market: 1) It’s a great place to visit. 2) It’s scenery is beautiful. 3) Its people are friendly. 4) Its schools are great. 5) Its homes are priced affordably. 6) Its a great place for a family, for empty-nesters, for retired couples, and for tourists.

Pacific Grove fits right in between the lack of a high-quality school district in Monterey and the presence of a high-quality price point in Carmel, making it the perfect place for many people.

The average sales price of the homes that have sold since the beginning of the year is $643,238. This is almost 97% of the average asking price, which was $665,917. The median sales price for these homes is $$535k, versus a median asking price of $550k. Again, a measly 3% difference. DOM (average days on market) for the homes sold in Pacific Grove this year is 154.

In conclusion, the hot market in Pacific Grove are homes that are priced between $500k and $700k. Such homes are selling in just over 5 months.

Please feel free to share your thoughts or questions below. I look forward to our discussion.

Happy Friday! Finish the week up strong and have a wonderful weekend!

~ Zach

Current Market Comments – Pacific Grove, CA; February 25, 2011

Pacific Grove – 2 new properties have come on the market since last Friday in Pacific Grove. One is a duplex priced at $560k, which I think is a great deal and will be added to my Best Buy list. 1 condo unit in Country Club Gate sold for $452k, down 11% from original asking price of $507k. We’re looking for closed sales to pick up in Pacific Grove, as 7 properties have gone into escrow over the past week.

The weather is treacherous. Stay safe, contact me if you know anyone who could use my help in selling their home or finding a great deal.

~ Zach

Brand New, turn-key Cape Cod Cottage in Pacific Grove

Brand new, 3 bedroom, 2 bathroom Cape Cod cottage in downtown Pacific Grove. Master, living/dining room and kitchen downstairs, 2 bedrooms and 2nd bath upstairs. Energy efficient home with amnifacturer’s life-time warranty on windows and roof. Granite slab kitchen and bathroom counters, crown molding, pre-wired for cable, telephone, internet, and surround sound. From Forest Ave, take Junipero toward Monterey. Go left on 8th. House is on the left.

Fast Facts

Calif. median home price: September 2010: $309,900 (Source: C.A.R.)

Calif. highest median home price by C.A.R. region September 2010: Santa Barbara So. Coast $879,750 (Source: C.A.R.)

Calif. lowest median home price by C.A.R. region September 2010: High Desert $124,960 (Source: C.A.R.)

Calif. First-time Buyer Affordability Index – Third quarter 2010: 64 percent (Source: C.A.R.)

Mortgage rates: Week ending 11/04/2010 30-yr. fixed: 4.17 Fees/points: 0.8% 15-yr. fixed: 3.57% Fees/points: 0.8% 1-yr. adjustable: 3.26% Fees/points: 0.7% (Source: Freddie Mac)

New program helps homeowners pay for energy-saving improvements

HUD is launching a new pilot program that will offer credit-worthy borrowers low-cost loans to make energy-saving improvements to their homes. Backed by the Federal Housing Administration (FHA), these new FHA PowerSaver loans will offer homeowners up to $25,000 to make energy-efficient improvements of their choice, including the installation of insulation, duct sealing, doors and windows, HVAC systems, water heaters, solar panels, and geothermal systems.

PowerSaver loans will be backed by the FHA – but with significant “skin in the game” from private lenders. FHA mortgage insurance will cover up to 90 percent of the loan amount in the event of default. Lenders will retain the remaining risk on each loan, incentivizing responsible underwriting and lending standards. FHA will provide streamlined insurance claims payment procedures on PowerSaver loans. In addition, lenders may be eligible for incentive grant payments from FHA to enhance benefits to borrowers, such as lowering interest rates.

First-time buyer housing affordability improves slightly in Q3

Housing affordability among first-time home buyers improved slightly in the third quarter of 2010, both on a quarter-to-quarter and year-to-year basis, according to C.A.R.’s First-time Buyer Housing Affordability Index (FTB-HAI). The percentage of first-time buyers who could afford to purchase an entry-level home in California stood at 66 percent in the third quarter of 2010. In the second quarter of 2010, the Index was a revised 65 percent and was 64 percent in the third quarter of 2009.

“With interest rates at historic lows, which have led to lower monthly mortgage payments, affordability continues to remain at near record-high levels in California,” said C.A.R. President Beth L. Peerce. “Another high point for first-time buyers is the current ratio between the California median price and the California median household income. During the third quarter, the ratio stood at 5 to 1 and was at a level we haven’t seen in the last 10 years. This is opening many doors for potential first-time buyers.”

First-time buyers, who tend to purchase homes equal to 85 percent of the prevailing median price, needed to earn a minimum annual income of $42,300 to qualify for an entry-level home of $266,620 during the third quarter of 2010. The monthly payment, including taxes and insurance, was $1,410, assuming a 10 percent down payment and an adjustable effective interest rate of 3.66.

Foreclosure activity rises 65 Percent in Q3

Foreclosure activity increased 65 percent nationwide year-over-year, according to RealtyTrac’s Q3 2010 Metropolitan Foreclosure Market Report. The report showed that cities in California, Florida, Nevada, and Arizona once again accounted for all top 10 foreclosure rates in the third quarter among metropolitan areas with a population of 200,000 or more, while cities outside those four states accounted for many of the biggest increases in metro foreclosure activity. California, Florida, Nevada, and Arizona cities also accounted for 19 of the top 20 metro foreclosure rates.

With one in every 36 housing units receiving a foreclosure filing during the third quarter, Modesto, Calif., posted the nation’s third highest metro foreclosure rate, despite a nearly 18 percent decrease in foreclosure activity from the third quarter of 2009. Other California metro areas in the top 10 were Stockton at No. 4; Merced at No. 5; Riverside-San Bernardino-Ontario at No. 6; Bakersfield at No. 9; and Vallejo-Fairfield at No. 10, according to the report.

A total of 48,849 properties in Los Angeles-Long Beach-Santa Ana area received a foreclosure filing in the third quarter, the second highest metro total, despite a nearly 3 percent decrease from the previous quarter and a nearly 30 percent decrease from the third quarter of 2009.

The Art of Listening-are you an Artist?

If we could master the Art of Listening the World at least our own, would be totally transformed. Clients would get what they want it, divorces would almost be eliminated, relationships would prosper, there is no end in site to the number of benefits.

Are You up to the Challenge?

There are three levels of listening:

Level 1 Listening: you are physically present to the conversation, however in your own mind you are preoccupied with yourself; about things you need to do, what you want to say next, how you want to control and dominate the conversation, judging the person you are listening to…etc, the consequence is that you are getting less then 10% of what the other person is saying to you-this way of listening can be very harmful when you are in Sales!

Level 2 Listening: you are able to stop all the stuff you are doing at Level-1 plus able to get over to the person (notice that in Leve1 you are with you-in Level 2 you are with them away from you) speaking, what I mean is that you can even lean over and put yourself in their situation, like what would it be like for them right now. You will get more then 50% of what is being communicated-this way of listening is very good when you are in Sales!

Level 3 Listening: you are able to satisfy Level 1 & Level 2 way of listening, plus listen from a place of nothing. What I mean is a place of no judgments no expectations-you know nothing. Now, from this place anything is possible. Also, something magical happens at this level and you can only get to it from here; you will be able to hear what they are not saying and get more then 90% of what is being communicated-this can be very valuable when you are in Sales!

A good way to start testing how good of a listener you are is to sit down with someone close to you and have them tell you how great they are for 1 minute-all you do is listen (make sure you have a timer on). After the minute is over, you need to repeat back to them what they said word to word. Have them tell you how well you did on a scale 1-10.

Zach Goldman, Realtor

(831) 392-6993